The 2022-2023 ADRFCO Survey from The Nonprofit Alliance found that 65% of fundraisers reported 2022’s results fell short of those from 2021. Unfortunately, the outlook for 2023 is also challenging. Inflation, volatility, and recession fears will undoubtedly impact charitable giving this year.

The good news is that billions in untapped funding is waiting to be harvested. More than 50 million households own $30 trillion in stock – more than eight times the amount of cash held by households over 45. Appreciated stock also presents the most tax-advantaged way to support nonprofits: donors not only avoid the capital gains tax on appreciated stock, but they can also itemize the fair market value of stock held more than 12 months.

Stock is a massive untapped source of funding representing $50 billion in potential giving every year.

Despite the overwhelming benefits, stock gifting has largely been utilized by the wealthiest donors and the largest nonprofits to date, for four main reasons:

- Few investors are aware they can avoid capital gains tax and deduct the current market value of gifted stock held more than one year.

- The manual process of initiating stock gifts is painstaking for donors and their financial advisors.

- Generally speaking, small nonprofits can’t open a brokerage account due to financial regulatory requirements that make it costly for retail brokers to support small charities.

- Nonprofits with brokerage accounts are unable to scale stock gifting given the complex, manual process, and a lack of data about the donor.

The benefits of an automated stock gifting solution

1. Pleasant donor experience

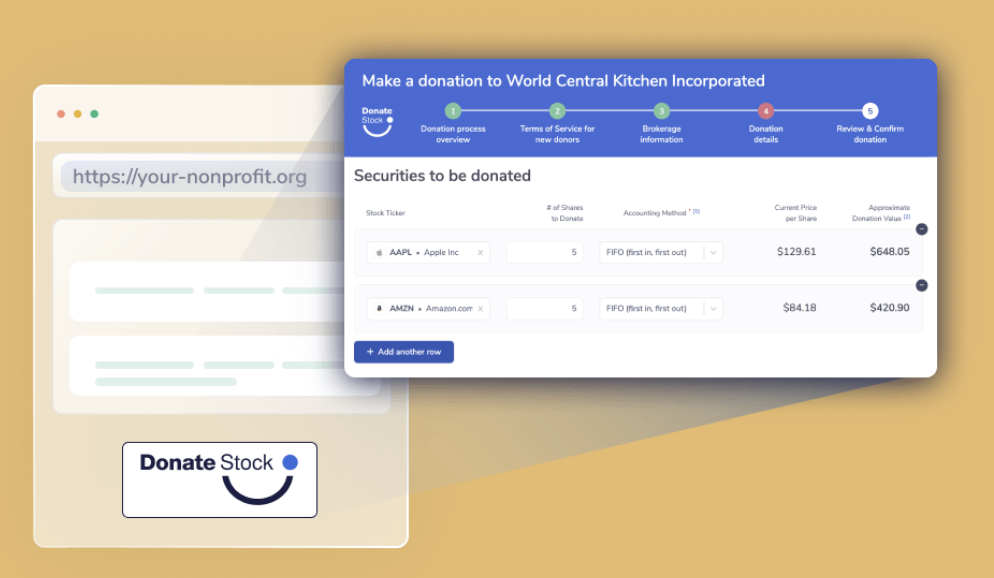

Historically, donors have had to jump through hoops to donate stock. It has usually required researching the process, contacting the nonprofit, downloading and completing forms, and submitting paperwork to their brokerage. It often took hours or even days to complete the process. This friction is a major deterrent to executing stock gifts. Solutions like DonateStock make the stock gifting process much easier for donors. Like PayPal for stock gifting, the donor can now initiate gifts in minutes at no cost.

2. Nonprofit efficiency and scalability

Processing stock gifts is a costly, manual process for organizations of all sizes. Facilitating requests for information, selling, reconciling, and acknowledging stock gifts is painstaking — even when the nonprofit knows who made the gift. If the donor does not inform the nonprofit of details (ticker, number of shares, and brokerage), the nonprofit won’t know whose stock was received. The inability to reconcile and acknowledge gifts in a timely manner creates problems for the operations, accounting, finance, and donor relations teams. The diseconomies of scale mean that the more gifts received, the longer it takes to reconcile each gift. With the right technology, what used to take days or weeks can now be done in minutes, enabling nonprofits to quickly acknowledge donors and account for each gift. As busy nonprofit staff, you won’t need to explain the convoluted stock gifting process to each donor, train and retrain its staff and scramble to process gifts. You also won’t need to worry about the unknown donors who are eagerly waiting for a thank-you note. With solutions like DonateStock, processing stock gifts can be a breeze.3. No brokerage required

As mentioned above, small nonprofits (which make up the vast majority of all nonprofit organizations) are largely excluded from stock gifting due to compliance requirements and restrictive policies of financial institutions. Financial services software can help. DonateStock solves this problem by processing stock gifts through DonateStock Charitable, a 501(c)(3), which will liquidate, reconcile, acknowledge, and distribute proceeds directly to the nonprofit. This allows nonprofits to offload administrative tasks while freeing up more time to acknowledge and build relationships with donors across channels.Roadmap for stock gifting success

- Get informed: We’ve condensed almost everything you need to know in the Ultimate Guide to Stock Gifting for nonprofits. The accompanying stock gifting guide for donors is also available for download.

- Educate your board and your team on the need to make stock gifting a key part of your fundraising program.

- Optimize your website – by making stock gifting a prominent option on your donation page and your “ways to give” page – to make stock gifting a prominent option for donors.

- Leverage research (like the figures provided above) to educate website visitors on the benefits of stock gifting.

- Make it newsworthy: Issue a press release to let donors know that you can now receive tax-advantaged stock gifts.

- Ask your board and major donors for stock gifts: It’s likely that most of your board members (and all of your major gift donors) own stock. Show them a better way to support your mission.

- Inform your donors: Send an email about the benefits and ease of donating stock, and how they can have a greater impact by making this kind of gift. Changing behavior takes time – start now and remind them throughout the year.

- Make it social: Include stock gifting in your social media posts, newsletters, and web communications.

- Integrate stock gifting language in all communications: newsletters, brochures, emails, donation requests, pledge fulfillments, etc.

- Communicate your successes! Nothing drives stock gifts like prior stock gifts. Share your wins with your supporters and create a virtuous cycle of support.