Nonprofit vs. not-for-profit: Definitions and differences

Nonprofit vs. not-for-profit organizations

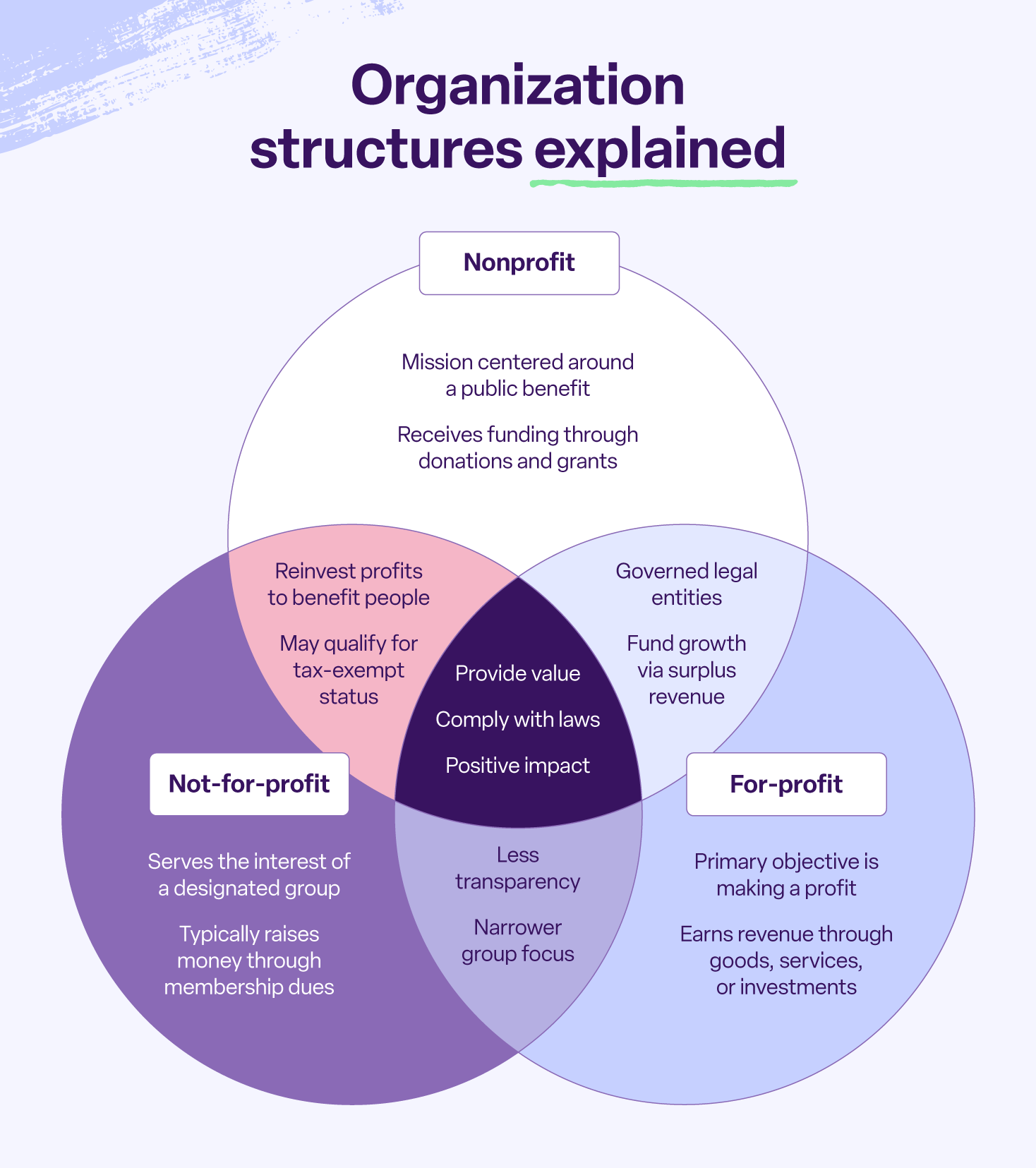

Where nonprofits serve a broad purpose for the public good with funding from donations and grants, not-for-profit organizations serve a smaller community or member base and are primarily funded by membership dues and fees.

Even though they sound similar, the differences between nonprofit vs. not-for-profit organizations are plentiful. Compared to for-profit organizations, both nonprofits and not-for-profit organizations seem interchangeable, but understanding the differences between them can inform how you structure and classify your organization, request funding, and conduct daily activities.

| Type of organization | Definition | Examples |

| Nonprofit | An organization with a clear charitable or altruistic purpose that invests any profits to benefit the public good | American Red Cross, Feeding America, Habitat for Humanity |

| Not-for-profit | An organization with a clear mission that invests profits or donations to benefit its members | Community sports teams, homeowners associations (HOAs), and parent teacher associations (PTAs) |

| For-profit | An organization whose primary goal is to generate financial profit for its owners, shareholders, or investors | Amazon, Starbucks, Microsoft, local restaurants, retailers, and mom-and-pop stores |

Regardless of which model you use, running a nonprofit or not-for-profit organization involves many moving parts. Make it easier for your team to manage your organization with one of the best nonprofit constituent relationship management (CRM) systems designed for organizations like yours.

Built with small to mid-size nonprofits in mind, Bonterra Network for Good is a comprehensive set of tools for donor and volunteer management, online fundraising, messaging, and more.

Are you a nonprofit looking to grow your impact? Get started with nonprofit software designed to help your organization grow your donor base, build stronger relationships, and ultimately make a bigger impact.

What is a nonprofit organization?

Nonprofits are organizations formed to benefit the public good through charitable initiatives and activities. Unlike other organization models, nonprofits do not distribute profits to shareholders, owners, or other individuals; instead, nonprofits must invest any profits they generate back into the organization, sponsoring activities, initiatives, and more that serve the organization’s stated purpose.

Most nonprofits are tax-exempt but tend to fall under different categories depending on their mission and structure. Generally, all nonprofits must:

- Serve the public good.

- Limit its documented goals to one or more charitable purposes.

- Engage primarily in activities that support its stated mission.

- Commit to financial transparency by submitting annual reports to the IRS.

- Avoid participating in political matters.

- Reinvest all profits into the organization.

Nonprofits are typically categorized as public charities or private foundations. In the U.S., most nonprofits are classified as 501(c)(3) organizations, but some nonprofits fall under a different 501(c) classification.

Nonprofit vs. 501(c)(3)

All 501(c)(3) organizations are nonprofits, but the inverse is not always true.

A 501(c)(3) organization is designated by the IRS using a subsection of the U.S. Internal Revenue Code, exempting it from federal taxes and allowing donations that are tax-deductible for donors. These tax deductions provide ample incentive for donors to contribute to fundraising efforts.

What is a not-for-profit organization?

Nonprofits and not-for-profit organizations are alike in that they serve a set purpose and do not seek a profit for shareholders or owners, but there are distinct differences in who they benefit and what tax-exempt status they can achieve.

Where nonprofits serve the public good, often with a charitable goal, not-for-profits focus on benefiting a smaller group or member base. Organizations like social clubs or recreational sports leagues generate revenue through membership fees or dues, events, and donations. Instead of paying proceeds to individuals, they reinvest profits into the organization to benefit their members.

Generally, not-for-profits must:

- Establish a member-focused mission or otherwise serve a designated group rather than the common good.

- Reinvest profits into the organization’s activities, services, or facilities.

Donations to not-for-profit organizations are typically not tax-deductible, and they may have a combination of paid employees and volunteers, much like a nonprofit.

What is a for-profit organization?

A for-profit organization is exactly what it sounds like: an organization designed to generate profits, which are distributed to investors, owners, and shareholders rather than reinvesting them in the company. Most businesses, from local stores to multi-national corporations, have a for-profit model.

Unlike nonprofits and not-for-profits, for-profit organizations earn money through investments, loans, services, or sales. They are less restricted in how they can use their profits, and while most businesses focus primarily on their bottom line, many also invest in corporate social responsibility (CSR) initiatives alongside their for-profit practices to support the public good and, as a result, improve employee engagement.

How nonprofit and not-for-profit organizations compare

When comparing not-for-profit vs. nonprofit organizations, it’s critical to recognize that though they both aim to satisfy a particular mission, they operate differently by design. The difference between nonprofit and not-for-profit organizations lies in their core missions and sources of funding, but these organizations differ in other ways as well.

Purpose and mission

Both nonprofits and not-for-profit organizations establish a goal or purpose that their activities and initiatives must generally support.

Nonprofits

Mission statements tend to pursue a broad public benefit beyond their local reach. Nonprofit organizations typically strive to have a positive social impact through their work, spanning from healthcare or education access to environmental conservation and cultural enrichment.

Not-for-profits

Not-for-profits typically have more localized goals centered around their community or member base. While they certainly provide value to their members and contribute to their communities, their core mission is focused on the needs and activities of that particular group, rather than the broader public.

Tax status

Both types of organizations can apply for tax-exempt status, though it is more common among nonprofits. Perhaps the most significant difference in tax status is whether donations are tax-deductible.

Nonprofits

A broad range of nonprofits may qualify for tax-exempt status, namely charitable, religious, or other service-based organizations. Contributions to a 501(c)(3) nonprofit are tax-deductible.

Not-for-profits

Fewer types of not-for-profit organizations are eligible for tax exemption, and donations to not-for-profit organizations are generally not tax-deductible.

To attain or maintain tax-exempt status, nonprofits must submit form 990 each year or risk losing the benefits of being a registered 501(c)(3) organization.

| Nonprofits | Not-for-profits | |

| Eligible for federal tax exemption | Yes | Yes |

| Donations may be tax-deductible | Yes, for 501(c)(3) nonprofits | No |

Organizational structure

For the most part, nonprofits and not-for-profit organizations have a fairly comparable structure, with a group of individuals making decisions for the organization. How these individuals are chosen and what they influence, however, varies.

Nonprofits

Nonprofits, namely public charities, are typically governed by a board of directors or trustees. This board is responsible for the organization’s mission, finances, and legal compliance. While nonprofits may have paid staff, volunteers play a critical role in their day-to-day operations, making it critical for these organizations to utilize a robust volunteer management software to encourage participation and simplify scheduling.

Not-for-profits

Not-for-profits also have representatives acting on behalf of their organizations, but they often elect officers who make decisions on behalf of their members. Volunteerism is also common, but it’s typically focused on activities that directly benefit members, such as organizing club events and maintaining facilities.

If you’re looking for a powerful volunteer management tool, Bonterra Mobilize is designed to help organizations of all sizes recruit, connect, and engage volunteers, empowering them to get more involved.

Legal entities

The legal status of organizations varies significantly between nonprofits and not-for-profits.

Nonprofits

Nonprofits, namely 501(c)(3)s, are established as separate legal entities, providing a legal distinction between the organization and its founders, directors, and members. This separation offers protection in the form of limited liability, meaning the personal assets of individuals associated with the nonprofit are generally protected from the organization’s debts or liabilities.

Not-for-profits

Comparatively, not-for-profit organizations may be unincorporated and operate without a clear separation between the organization and leadership or members. Without that distinction, there may be fewer protections, potentially making leaders or members personally liable for the organization’s actions.

Transparency and financial reporting

Both types of organizations must uphold some level of transparency, but who they report to tends to vary.

Nonprofits

For the purposes of public trust and legal accountability, 501(c)(3) nonprofits must make their annual financial reports publicly accessible.

Not-for-profits

On the other hand, many not-for-profit organizations, particularly those focused solely on their members, are not obligated to make their financial records public.

Activities and initiatives

Depending on the organization’s mission, nonprofits and not-for-profit organizations may conduct similar activities.

Nonprofits

Nonprofits undertake initiatives to address broad societal challenges or improve conditions for a wide demographic, aligning with their public benefit mission.

Not-for-profits

Since not-for-profit organizations typically serve a smaller group rather than a larger goal, they tailor their activities to directly benefit their members or constituents.

Donations and funding

Both organizations can accept donations, but their funding models differ.

Nonprofits

Nonprofits heavily rely on philanthropic donations, which are often tax-deductible for the donor. Cultivating donor relationships, including strategies like planned giving, is crucial for nonprofits.

While not-for-profit organizations can accept donations, they are not tax-deductible, which tends to be less appealing to donors. Instead, they primarily rely on member-generated revenue like dues and fees.

Fundraising goals

Neither type of organization aims to generate private profit. Instead, their fundraising goals are tied to their missions.

Nonprofits

Nonprofits can use a variety of fundraising ideas to finance programs, expand their reach, and cover operational costs to achieve their goals, measuring success by their impact.

Not-for-profits

Not-for-profit organizations raise money to support the services, facilities, and activities that directly benefit their members, ensuring the organization’s viability for its specific group.

| Characteristic | Nonprofit | Not-for-profit |

| Purpose | For the public good Example: Organizations providing education, healthcare, or environmental protection | For the good of its members Example: Professional associations, social clubs, or community theaters |

| Tax status | May be tax-exempt Example: A 501(c)(3) organization | May be tax-exempt Example: A 501(c)(7) social club or a 501(c)(6) business league |

| Structure | Governed by a board of directors or trustees Example: A charity with a board overseeing its programs and finances | Governed by elected officers Example: A homeowners association with an elected board |

| Legal entities | Separation between organization and its members Example: An incorporated entity, offering personal liability protection | Less separation between organization and its members Example: An unincorporated association where leaders may be personally liable for its actions |

| Financial reporting | Publicly accessible annual financial reports Example: A large foundation’s annual spending reports available online | Financial records generally not public Example: A private golf club’s financial statements shared only with its members |

| Activities | Initiatives address broad societal challenges Example: Running programs to combat homelessness or advocating for policy change | Activities directly benefit members or constituents Example: Organizing exclusive member events or maintaining shared facilities |

| Funding | Tax-deductible donations and other contributions Example: Individual contributions, grants, and corporate sponsorships | Primarily sourced from members Example: Recurring membership dues and other fees |

| Fundraising goals | Finance programs, expand reach, and cover operational costs Example: Raising funds to build a new hospital wing or launch a literacy program | Support services, facilities, and activities for members Example: Collecting dues for clubhouse maintenance or organizing member-exclusive trips |

Nonprofit vs. not-for-profit examples

Understanding the nuances between nonprofits and not-for-profit organizations is essential for anyone involved in or considering these organizational structures. While both are driven by a specific mission beyond private profit, their operational models, legal frameworks, and financial characteristics set them apart.

Consider these real-world examples of nonprofits and not-for-profit organizations to understand how they’re different.

| Organization | Classification | Activities | Funding |

| The American Society for the Prevention of Cruelty to Animals (ASPCA) | 501(c)(3) nonprofit public charity | Rescuing and protecting animals nationwide to prevent animal cruelty | Primarily through tax-deductible donations from individuals, corporations, and foundations |

| National Association of Realtors (NAR) | 501(c)(6) not-for-profit business league | Lobbying for real estate legislation, providing professional development and networking opportunities for members | Primarily funded by membership dues from real estate professionals and fees for conferences or publications |

| Doctors Without Borders | 501(c)(3) nonprofit public charity | Delivering impartial humanitarian aid, offering emergency medical care, providing vaccinations, and responding to epidemics | Largely supported by tax-deductible donations from individuals, private foundations, and some institutional grants |

| Girl Scouts of America | 501(c)(3) nonprofit public charity | Providing leadership development programs, educational activities, and community service opportunities for girls to build courage, confidence, and character | Program fees, cookie sales, and tax-deductible donations |

| A local Veterans of Foreign Wars (VFW) post | 501(c)(19) not-for-profit veterans’ organization | Hosting social gatherings for members, providing support services to veterans and their families, and advocating for veterans’ benefits | Largely from member dues, proceeds from social club activities, and some limited public fundraising |

Maximize the impact of your nonprofit with Bonterra

Whether your organization serves the broad public good or a specific membership base, the right technology can be a game-changer. Both nonprofits and not-for-profit organizations stand to more effectively achieve their goals by leveraging purpose-built software like Bonterra Network for Good.

From streamlined donor management and efficient volunteer coordination to robust financial reporting and impact tracking, integrated solutions like Bonterra Network for Good can empower your organization by automating tedious tasks, providing valuable insights, and freeing up critical resources, allowing your team to focus more on what truly matters: serving your community or members.

FAQ

What makes a nonprofit a nonprofit?

A nonprofit is an organization formed to serve the public good with a commitment to a charitable purpose or social cause. By definition, nonprofits cannot collect and distribute profits; they must invest any profit back into the organization to serve their goals.

Is not-for-profit the same as nonprofit?

No, a not-for-profit organization is not the same thing as a nonprofit. While both types of organizations reinvest any profit they make, nonprofits are centered around a broader purpose, whereas not-for-profits typically serve a smaller group, often their local community or a member base.

What is the difference between a nonprofit and a 501(c)(3)?

A 501(c)(3) is a type of tax-exempt nonprofit recognized by the IRS for its charitable, religious, educational, or otherwise beneficial purpose. Donations to a 501(c)(3) nonprofit are tax-deductible, making these contributions more appealing to donors.

What do nonprofits do with profits?

Nonprofits must invest any profits back into the organization to better serve their mission. Profits may be allocated to:

- Fund or expand programs.

- Conduct facility maintenance.

- Hire and train staff.

- Organize and host events.

Can a nonprofit become a for-profit?

Yes, a nonprofit can become a for-profit organization, but the process can be labor-intensive and time-consuming. To make the switch, an organization must make significant changes to its legal structure and financial assets.

Are not-for-profits tax-exempt?

Only certain not-for-profits are tax-exempt. Not-for-profit organizations classified as 501(c)(6) business leagues or 501(c)(7) recreational or social clubs are considered exempt.

Work with Bonterra